Case study: Tracking the success of a rebrand with BePure

BePure creates clinically backed supplements that help consumers take ownership of their health. The business was founded in 2004 and built brand awareness with BePure’s founder traveling around New Zealand and giving talks to health-invested consumers.

Over the years, the BePure business model pivoted away from an events-driven approach and towards growing its ecommerce and retail footprint.

Brand Marketing Manager Emily Parks says this has led to a reevaluation of BePure’s brand in its current state and whether it’s successfully building both immediate and future demand with consumers.

BePure recently underwent a rebrand with Previously Unavailable and debuted its new look and feel through a campaign called Essential Energy

Emily says this is the biggest shift in branding BePure has undergone in its 19-year history.

“The rebrand was to change our brand perception from being quite holistically and naturally health focused, which was the identity of the brand when it was founded, to be more scientific, clinical, and aligned with the changing customer demands and needs today,” Emily says.

BePure Ecommerce Manager Cheyenne Welham says the rebrand is moving away from the business’s Founder story and really digging deep into why BePure exists, who its current customers are and who its future customers could be.

“What does our Future Demand customer look like, and what is BePure without our Founder at the forefront? How do we talk about our brand, and how do we connect with our customers? These were all questions that Previously Unavailable helped us answer,” Cheyenne says.

Tracksuit is the BePure team’s tool of choice to track the impact of this rebrand in real time, as they can monitor whether they’re growing their top-of-funnel brand metrics, if they’re growing specific segments of consumers that have been underserved, and whether consumer sentiment is changing as a result of campaign activity out in market.

The importance of consumer research 📈

When BePure set out on its rebranding journey, they wanted to better understand their current customer base, as well as active consumers in their category who might not have bought from them yet, but could purchase from them in the future (AKA future demand).

They went through an extensive consumer research process, including a qualitative survey that went to their existing customer base through an EDM (nearly 200K people) which provided rich insights.

Previously Unavailable also carried out qualitative and quantitative research with consumers that used supplements, but weren’t currently using BePure products.

What emerged from the research was that these potential future customers wanted more of a focus on everyday health, such as increasing energy levels, getting a better sleep and managing anxiety.

“These people are more interested in everyday health, and that's where the energy piece comes in,” Cheyenne says. “They’re wanting to feel more energetic and get more out of life, but they’re not overly health-conscious.”

They also identified an untapped customer opportunity with younger consumers and male consumers, as previously BePure’s customer base skewed female and older.

“These are the people that would be a great next audience for BePure to start targeting to grow our brand that we hadn't tapped into yet,” Emily says.

Previously Unavailable Creative Strategist Phoebe Smith says the great part about working with BePure on their rebrand was they already had a really strong range of products and a loyal customer base.

“Our job was to find out what parts of BePure resonated the strongest, learn what general consumers want most when it comes to health, and then develop a brand strategy to connect the dots,” Phoebe says.

“BePure’s existing customers know they’re experts in gut health, but what the average consumer might not know is how much gut health is connected to energy — which is what our research showed people were after.

“Our strategy was largely about bringing energy to the forefront of the brand, and landing it in a way that could connect and resonate. Consumers are looking for a good baseline wellness, which is what we termed ‘essential energy’.”

The rebrand results 🔥

BePure’s rebrand launched April 26 and the business saw an immediate lift in key results. The week after launch, website sessions increased 5.6% week-on-week.

The brand’s ecommerce conversion rate also increased 55% month-on-month in May when compared to April.

As well as this, the demographic makeup of visitors to BePure’s website has evolved. The number of male visitors has grown from 17% to 29%, while the top age bracket visiting the website has changed from 65+ (24%) to 25 to 44-year-olds (46%).

“In terms of Tracksuit, something that was really exciting to see was the direct impact of our campaign going live (including billboards which was a first for us). We were sitting at 17.6% brand awareness in April, jumping to 20.2% in June and the goal is obviously to maintain this level of brand awareness from here on out,” Emily says.

Since the rebrand in April, Tracksuit’s data shows that BePure has successfully maintained this brand awareness.

According to our Brand Benchmarks Tool, in 2023, a 3% increase in awareness is considered outstanding growth for brands in the vitamins and dietary supplements category.

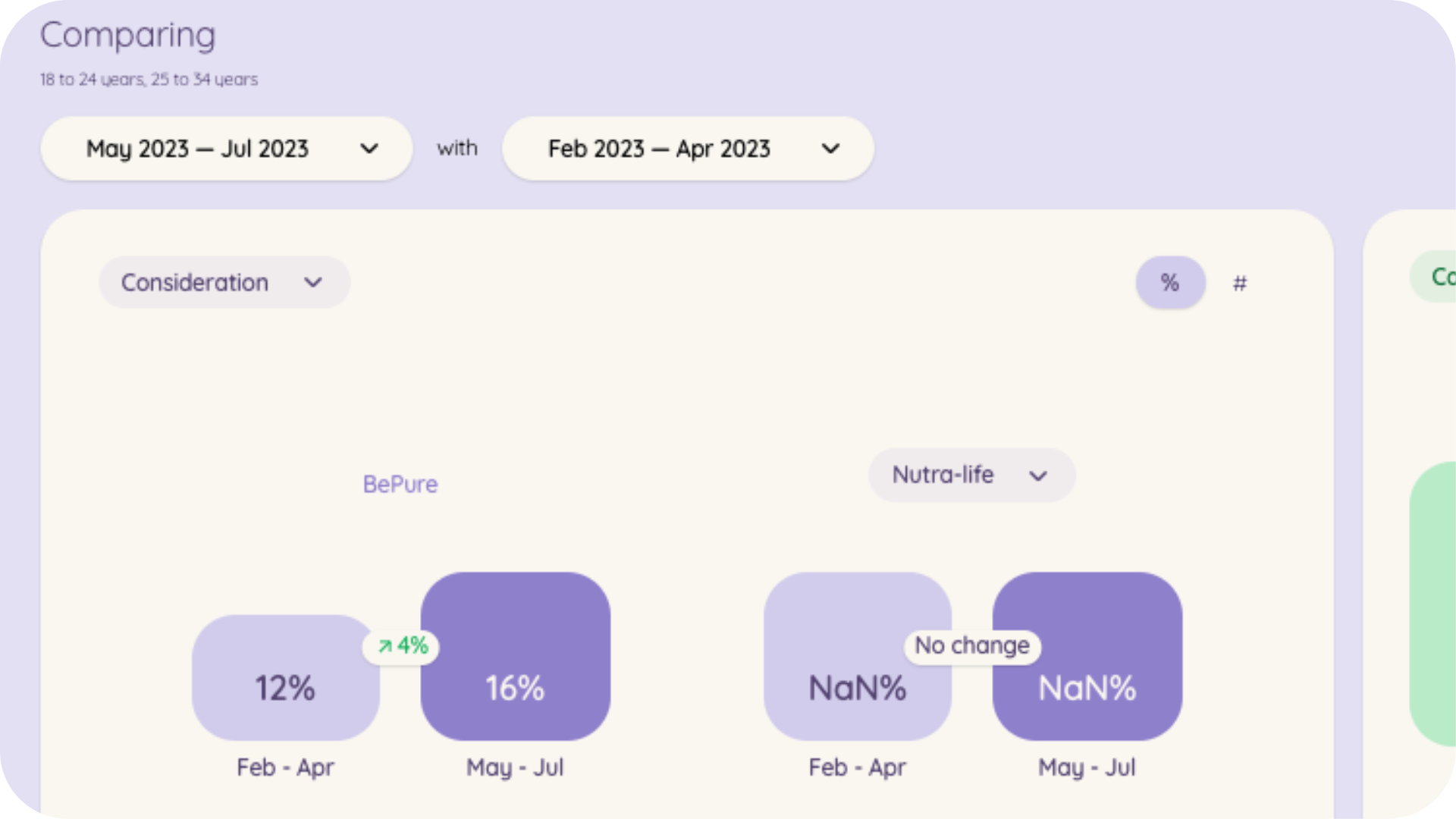

Younger consumers are also resonating with the BePure brand more. From May to July, BePure has increased consideration with 18 to 34-year-olds by 4% when compared to the previous three months. That’s an extra ~25,000 consumers considering the brand.

This growth is also despite the number of active consumers in the health supplements category falling from ~630K in Feb to April to ~588K in May to July.

Previously Unavailable’s Phoebe says BePure is in a great position to go broader than their current customer demographic.

“Traditionally, their customer has leaned females aged 30 to 50, but you can expect that to diversify a lot in the future. The growing interest in health and wellness across the board means younger consumers in particular are much more health conscious, we have a growing, aging population with health needs, and men more health interested too.”

Emily says the brand will be focused on consistent above-the-line activity for the rest of 2023 to keep BePure top of mind for consumers in such a crowded category.

Prior to the rebrand with Previously Unavailable, Cheyenne says BePure over-focused on short-term ROI, which is a common pitfall of many brands. Now, the business has shifted its marketing strategy to heavily invest in brand, with 70% of the budget geared at long-term brand building and 30% at short-term performance marketing for the rest of 2023.

“The job with our rebrand is certainly not done,” Emily says. “That's something that we're going to continue, and we'll continue to roll out across the rest of the year to make sure that we're having strong consistency in our messaging in everything that we do.”

“We're focusing more on bringing people and bringing emotion through to our marketing and doing things like lifestyle photoshoots, which we wouldn't have done in the past. This means we'll have more assets to work through that help people connect with our brand, which is really exciting,” Emily says.

While previously insights gleaned from brand tracking felt like something exclusive to large corporate businesses, the BePure team can use Tracksuit to keep tabs of the impact of their rebrand going forward.

“Too often in brand marketing we struggle to quantify the impact of the work we do and dollars we spend. But now we have the data to back it up," Emily says.

To see more of BePure’s rebrand, check out their Instagram and website.