How brand metrics can help you land venture capital funding

Brand tracking is a useful tool to have on hand at each step of the journey for a growing business, whether it’s launching a new product, expanding into new geographies, or measuring the impact of large-scale marketing activity like a campaign.

But one lesser known use case that brand tracking can be incredibly helpful for is supporting investment and acquisition conversations – and ultimately, decisions (on both investor and brand sides of the table).

Even if a business is still in its early stage and its awareness and consideration aren’t trending high yet, brand, competitor and category metrics provide an amazing way to demonstrate potential future growth in investor conversations. Here’s a brief FAQ on key investment terms we’ll be using throughout this article 👇

Sign up to Shorts

For fortnightly brand insights, stories and goodness that'll help you win (we promise).

What is the difference between private equity and venture capital?

Venture capital (VC) investments are typically made with early-stage start-ups in exchange for an equity stake in the company, while private equity (PE) investments are often made with more mature, stable companies in the form of a buyout.

PE and VC investments differ in the sizes of the businesses they invest in, the amounts of money committed, and the stake that they get in the companies they’re investing in.

How do start-ups get venture capital funding?

During the direct-to-consumer (DTC) investment boom, VC firms didn’t necessarily see the returns they wanted from the companies they poured money into due to increased competition and the cost of customer acquisition (CAC) rising.

While identifying current demand and securing the first 1000 customers is one thing, consistently building future demand for your product or service is another. Many start-ups were challenged when their growth plateaued and they failed to deliver on projected revenue.

In 2024, firms are now increasingly selective of who they invest in. They want to see clear evidence of growth potential from start-ups, which can come in the form of top-of-funnel brand metrics.

What do the VC and PE firms think of brand metrics? 🤔

From the investor perspective, the VCs we spoke to were in agreement that the former growth hacking playbook for DTC start-ups no longer works. Return on investment with short-term performance marketing channels like search has declined and CAC has increased ($1 in = $1.50 out).

Now, VCs are asking more pointed questions to start-ups around investment into the top of the funnel marketing to fuel future demand, not just their ability to harvest what’s already available in market (and will inevitably be exhausted).

When Tracksuit was raising its seed funding round, Co-CEO and Co-Founder Connor Archbold came across this in investor conversations, as detailed in his Mi3 podcast interviewOpens in new tab

New York based agency Red AntlerOpens in new tab partners with businesses to challenge what is and build what’s next. They’ve worked with brands like Casper and Allbirds pre-launch, brands like Hinge and Supergoop during their growth stage, and established businesses such as Google and HBO.

Red Antler Director of Go To Market Maggie Saus says the barriers to exist as a business have never been lower.

“Every category is up for grabs. The number of players is infinite. Sustainable brand building is going to require more pull and less push, with meaningful, resonant storytelling being rewarded over the traditional performance marketing playbook,” Maggie says.

“Focusing on the strength of the gravitational pull of your brand at an awareness level is critical to creating long-lasting and well-loved brands that survive the shifting market, platform, and consumer landscapes.”

New York early stage venture capital fund Lerer HippeauOpens in new tab invests both in consumer and enterprise businesses in sectors like robotics, climate, AI, fintech, and the creator economy.

Lerer Hippeau Director of Marketing & Communications Emily Libresco says as early-stage investors, the fund looks closely at organic traction when doing due diligence on potential investments.

“It's no longer tenable for brands to buy growth – they must have built-in brand awareness and community earlier in their life cycles than ever before,” Emily says.

"In an economic moment like this one, though, all companies seeking investment from our firm or others must demonstrate keen financial fitness and be more rigorous about planning and execution than in some previous eras.”

Blackbird is an Australasian venture capital firm that invests in every type of technology, from software to space. Blackbird has invested in tech darlings such as Canva, Dovetail and Tracksuit (hi, that’s us 🙋♀️)

Blackbird Ventures General Partner Phoebe Harrop says investors love metrics of all kinds because they provide clues to business health and what the future might hold.

“One thing that's always on investors' minds is figuring out how well a business can find and convert new customers, at low cost: both now and into the future. In the past we've been as frustrated as marketing teams by not understanding the brand awareness part of the funnel well,” she says.

“Tools like Tracksuit can help provide clarity around what's working, what's not, and where a brand is at, relative to its competitors and its objectives,” Phoebe says. “That is absolute gold dust for nerdy investors. And the mere fact of teams measuring and acting on this stuff is a great signal of quality.”

Brand metrics 🤝 demonstrating future growth

If you’re a business starting investment conversations, brand metrics provide a tangible way to demonstrate demand for your particular product or service.

If significant demand isn’t quite there yet, data brand tracking providers like Tracksuit capture still provide an overview of active consumers in your category across the entire geography, which means you can accurately get a read of the total addressable market (TAB).

Joe Carter is the Founder of Ironclad PanOpens in new tab, a cast iron cookware brand retailing in Australia and New Zealand that guarantees three generations of use with a 100-year warranty.

Joe says he’s using his Tracksuit top-of-funnel brand metrics to further conversations with possible investors in Ironclad Pan. Currently, the brand is pre-investment and sitting at 12% awareness and 9% consideration in the Australian market.

“We've been bootstrapped as a company to date and at the moment, we are doing an equity crowdfunding raiseOpens in new tab,” Joe says.

“Part of that is we need to provide a whole bunch of evidence around what's the growth opportunity for Ironclad Pan, and for us that opportunity is Australia. Being able to access market reports, and trend reports, and all this kind of stuff is really expensive so being able to see Ironclad versus the competition across multiple different contexts on Tracksuit is incredible.”

“We have 12% awareness and a category size of 11 million people, and we only have 3000 customers. So when you put those three figures next to each other, you can really easily, visually see where the opportunity is.”

Joe says even though Ironclad Pan is still a lean, early-stage business, the insights he gets out of Tracksuit’s platform are valuable as he begins the funding journey.

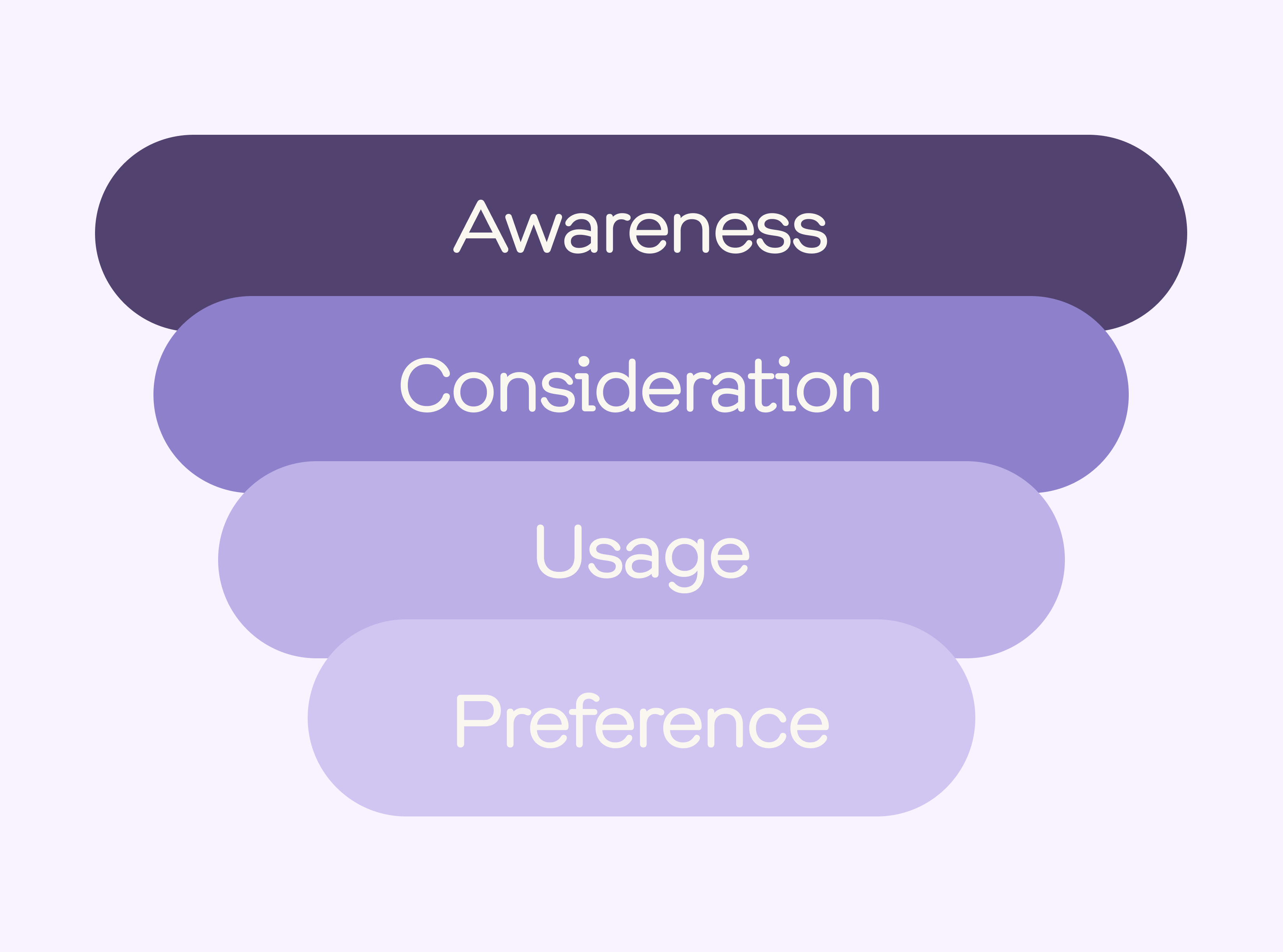

“It's a priority for us as a small business because we need to know that every media dollar that we spend is actually making an impact across each stage of the marketing funnel,” he says. “Being able to simplify that marketing funnel into plain language so that chefs that we work with, film directors that we work with and that people outside of the marketing team actually understand it is really, really good for us."

He says being able to filter brand metrics by demographics and drill down by geography, gender and age is another useful feature to share with stakeholders.

“It’s incredible, I can't do that with any other tool. It shows to our investors and other shareholders what the focus is and just how big the opportunity is in terms of the total addressable market.”

Made By Nacho is a pet food business that’s a bit further along in its funding journey. The chef-crafted cat food company was founded by celebrity chef Bobby Flay and food industry veteran Elly Truesde and raised a series A of $14 million USD in 2022.

As a Tracksuit customer, the brand is using top-of-funnel brand health metrics to map how awareness and demand is growing over time. Tessa Gould, formerly CEO at Made By Nacho, says consumer brands often direct the attention at the wrong metrics in investor conversations.

“All too often consumer brands – particularly when fundraising – will point to the strength of their brand as a defensible moat and key reason to invest but fall short of supporting the claim with meaningful quant and qual data,” she says.

“If anything, they'll point to their nice branding and/or Instagram following, when what they should really be showing is how many consumers are aware of and would consider buying their brand, and ideally how that's grown over time.”

The top brand metrics to bring to investor chats 💸

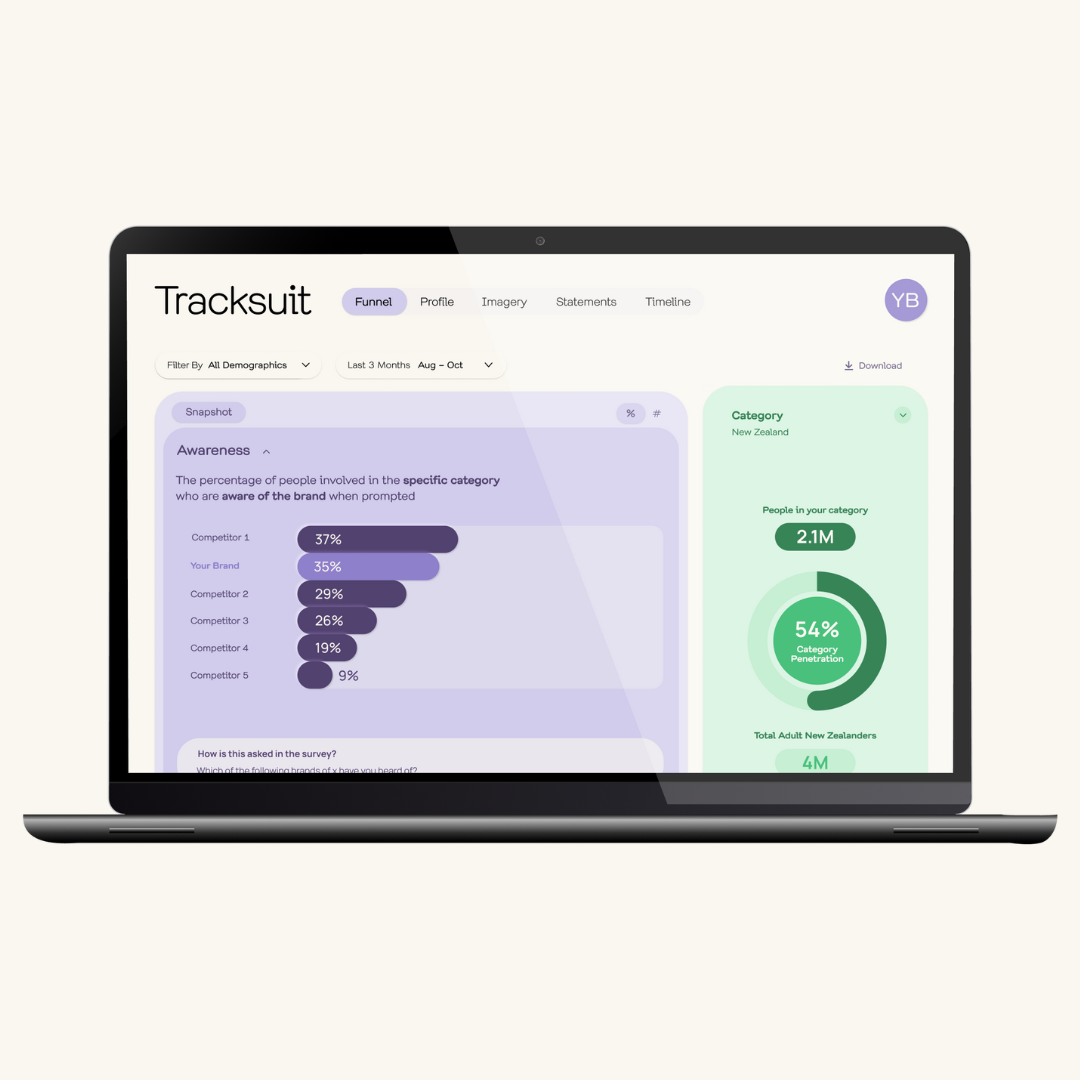

Want to prove your brand’s strength and ability to build demand? Here are the metrics from your Tracksuit dashboard that investors will be most interested in.

1. Total addressable market (TAM)

Knowing how many active consumers are in your category, versus how many are aware of your brand will be key to investors. This shows them how big the opportunity is for your brand to grow and can signal the maturity of a category against the total population size and whether it's growing (confectionery), stable (health and beauty) or diminishing (fashion) as of 2024.

2. Top-of-funnel conversion

How well are you moving active consumers in your category through the funnel, from awareness through to consideration? This helps demonstrate that your business is creating future demand for your product or service through brand building, and not just angling your entire marketing strategy at short-term performance marketing.

3. Demographic profiling

Where are you over or under-indexing in consumers when comparing your brand to the category average? This helps you identify opportunities for growth by getting more granular on who your potential customers could be, and which competitor brands potential customers are resonating with.

The finishing line 🏁

Securing investments in your brand isn’t just about getting quick wins and short-term growth. It’s about demonstrating that your business is worth investing in for the long-term. This is why brand-building is vital. Establishing a strong brand enables you to gain awareness in your target market and generate future demand.

To that end, you can use Tracksuit to monitor your brand performance over time. Our brand tracking platform offers a holistic overview of brand health and extract easy-to-understand insights to present to your team. Request a demo to learn more.