Embracing change: how home and furniture brands can thrive in a post-COVID world

If there’s anyone who knows how to pivot and then pivot again, it’s direct-to-consumer (DTC) home and furniture brands 🛏️

Not even a decade ago, the furniture industry was completely disrupted when companies like CasperOpens in new tab adopted a DTC approach to eliminate the middleman and market and sell their products directly to consumers.

By 2019, DTC furniture brands had an average monthly increase in sales of almost 30%,Opens in new tab while traditional furniture companies’ growth rate remained mostly stable. Online furniture retailers also profited from the pandemic as millions of consumers spent their extra income on home renovation projects. US furniture retail sales reached a then all-time high in 2020 and 2021, with sales regularly passing US$ 11 billion each monthOpens in new tab 🤯

However, in a post-COVID world, DTC retailers have had to adjust their strategy to include physical stores, brand pop-ups, and activations. In-store shopping is back in a big way, with sales in physical stores growing.Opens in new tab So how has this changed the market at large?

First, we’re seeing that brands need to report to stakeholders on metrics like brand awareness, consideration, preference, and purchase to help ensure they’re on the right track in a crowded niche. DTC brands also need to invest in extensive brand and performance management to raise awareness and build future demand (plus, by proactively building brand equity, businesses can avoid price fluctuations during economic instability, which in turn can help attract customers).

Consumer expectations are evolving, too. Remember, shoppers today are more switched on than ever before. In addition to being tech-savvy, consumers have highly attuned BS detectors that can detect inauthentic brands from a mile away.

As such, they’re expecting more brands to build trust into the customer journey.

Finally, as the market becomes more cutthroat, some brands have begun to diversify their product offerings to reach more consumers. For example, our customer KoalaOpens in new tab has done so by expanding from mattresses into bedroom and living room furniture (which is a strong growth opportunity, but one that needs to be closely tracked). Meanwhile, Bed ThreadsOpens in new tab is best known for their bed sheets, but has also diversified their product range into sleepwear, towels, throw blankets and even menswear.

Here’s the good news: the realm of DTC furniture remains promising 🙌

Tracksuit’s data shows that in the US, nearly 195 million consumers have purchased household furniture or homeware in the past year.

In Australia, that number is 13.3 million (that’s two thirds of the Aussie population), while 16.3 million have bought bedding items in the past two years.

But with a continual uptick in competition and a retail landscape that’s always changing, brands that don’t reinvent and adapt will be left behind. In this article, we’ll look at the top ways your DTC furniture brand can win in today’s market for tomorrow’s success.

Let’s get started!

Sign up to Shorts

For fortnightly brand insights, stories and goodness that'll help you win (we promise).

1. Measure and promote brand awareness 📈

Long-term success isn’t guaranteed by having a strong brand. Instead, you need to adapt to a shifting landscape and guarantee your brand always resonates with your target audience. That’s why it’s important to conduct regular brand audits and market research to help see if brand awareness is converting to purchases.

But what exactly is brand awareness? Though it’s an often ambiguous-sounding metric, it’s critical to help build a strong case for brand marketing, and helps your brand achieve sustainable growth (by the way, there are more benefits, which we talk about here).

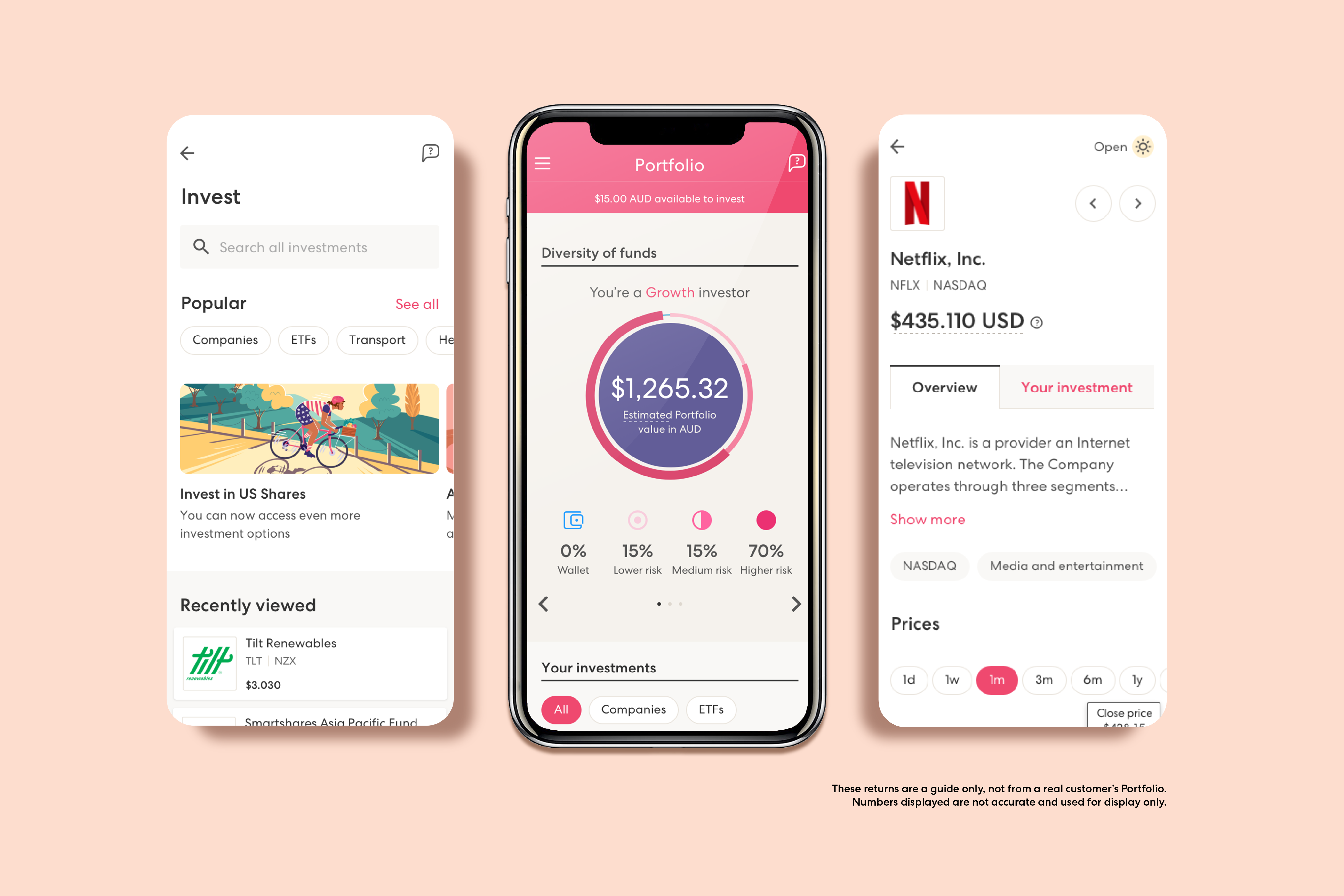

At Tracksuit, we provide always-on brand tracking and research at a fraction of the cost of traditional market research products, like an annual dip. That way, it’s easy to understand exactly what active consumers in your category think, feel, and know about your brand (and competitors) all the time. Hello, actionable, brand-centric insights 👋

2. Promote trust and flexibility through trial periods 🤝

If your home and furniture brand doesn’t have a physical showroom, customers won’t be able to physically try a product until it’s delivered to their home. That’s why you should instill confidence by empowering them to try out your product risk-free for an extended amount of time.

For example, our customer KoalaOpens in new tab offers a 120-night trial for their mattresses, meanwhile, NectarOpens in new tab offers a 365-night trial. While this extent may not be realistic for all home and furniture brands, it’s important to be as flexible as possible.

3. Have your customers’ back 🫂

In the unfortunate event your product malfunctions or needs to be replaced, you need to make sure the post-purchase experience is top-notch to build customer loyalty. Don’t make them jump through hoops or charge them exorbitant costs to get your product fixed, as doing so can decrease customer trust (which is absolutely vital for successful brands!)

So, who’s doing it right? Personally, we like Nectar and Koala’sOpens in new tab forever and 10-year warranty, respectively. Again, flexibility is key.

4. Set up shop offline 🛍️

Having a physical presence can help furniture ecommerce brands reach a broader audience base and dramatically increase brand awareness through more visceral touch-points, like Casper does with their own mattress stores.

That said, having a dedicated brick-and-mortar retail strategy isn’t an option for all ecommerce furniture brands: partnerships can be the way to go (Casper also sells their mattresses through other department stores and mattress shops).

In addition to their pop-up retail locations, they had a pay-per-nap location in NYC called the Dreamery, which was a creative branding opportunity that didn’t directly sell its products to its consumers, but rather focused on moving potential customers into the brand consideration stage of the brand funnel.

5. Weave technology into the customer journey 📱

Remember when we said that shoppers today are incredibly tech savvy? Make sure your brand can keep up.

Category leader IKEA launched an augmented reality (AR) applicationOpens in new tab powered by Apple’s iOS ARKit technology, allowing users to scale and place realistically-rendered 3D objects into their living space via their phone. It’s a simple, clever way that makes it easier for consumers to visualize how your furniture products would look, making the process easier for customers and removing potential purchasing barriers.

6. Offer flexible payment plans 💸

Buying furniture can be quite the investment for consumers, but an easy way to help soften the blow is to offer payment plans that help make it easier to buy products. Paying in installments, or Buy Now, Pay Later (BNPL) has become increasingly popular,Opens in new tab especially for online shopping, so it’s worth partnering with a financier to help meet your customers’ expectations, like Tracksuit customers AfterpayOpens in new tab or LaybuyOpens in new tab offer with their buy now, pay later programs.

7. Customize products with design services 🎨

Another way direct-to-consumer home furniture retailers can diversify is by offering design services to help customers enhance their home. It’s a great way to build brand awareness with new or customers, while offering a much-needed service for most clients.

A great example of a brand doing just that is JoybirdOpens in new tab, which offers customisable furniture and free design services. If shoppers are searching for a local design specialist online, chances are high they’ll end up on Joybird’s site and purchase some furniture along the way.

The finishing line 🏁

As the landscape of DTC retail continues to evolve, it’s hard to predict exactly how it’ll look in the near future. What we do know, however, is that the same mantra applies as always: those who embrace change will survive in the long run.

Ready to commit, but don’t want to be flying blind in monitoring your brand strategy? With Tracksuit, you can take the guesswork out of strategic planning and make sure your home and furniture brand resonates with your audience.

With real-time, actionable insights, we make it crystal clear exactly what your target audience and consumers are thinking about your brand. No vanity metrics, just beautifully visualized, invaluable brand tracking data.

Request a demo today to learn more about how your furniture brand stacks up against your competitors and start growing your brand.