Case study: How Surge SMC negotiated 4x the shelf space with brand tracking

It’s fair to say that growing a brand in FMCG is not for the faint hearted. With so many food and beverage products competing for consumers’ attention on the retail shelf, one of the strongest differentiators is brand.

“The only way you stand out in a retail environment is having a brand that people choose to buy over others. That’s why brand strength is critical,” Surge SMC managing director Tony Trilford says. Opens in new tab

Surge SMCOpens in new tab is a food marketing business that champions challenger brands in the FMCG industry. It works with food and beverage clients to grow their sales through shelf space management, category management, trade marketing, strategic direction and helps them expand into new retail channels and product categories.

Some of the FMCG brands Surge SMC represents include Horleys (protein powder and dietary and performance supplements), Baby Steps (a goat’s milk drink for children), Isey Skyr (cultured dairy products), Venerdi (gluten free, paleo and keto bread) and Makikihi Fries (New Zealand made potato fries). 🍟

Despite the different industries they play in, all these businesses are using Tracksuit to measure the strength of their brands and see how consumers’ awareness, preference and usage of their brands is changing over time.

Tony says Tracksuit’s data has become an invaluable tool to negotiate for shelf space, as it demonstrates the kind of products consumers want in conversation with supermarkets and other stockists.

“We’ve moved the dial on category discussions with the retailers. We’ve had products that weren’t being considered for ranging, but with the consumer insights we can now bring to the table, we can show the benefit for the category based on consumer preference and usage in the total market. In one case with Foodstuffs North Island, our client gained 4 times the compulsory ranging we had prior,” he says.

“We’ve found Tracksuit’s data really valuable going into discussions, as we can say, ‘These are clues as to what’s happening in your category and this is where the consumer headspace is at, irrespective of whether they bought this brand in one of your stores’.”

Sign up to Shorts

For fortnightly brand insights, stories and goodness that'll help you win (we promise).

Leveling the playing field

Before winning over consumers at the point of a purchase decision, getting placement in-store can also be a challenge to overcome for food and beverage brands.

With hundreds of brands to choose from to stock in each category and only two major grocery retailers in New Zealand (Foodstuffs, which manages New World and Pak ‘n Save, and Woolworths Group, which manages Countdown and Fresh Choice) competition is fierce. Often, the strength of a product’s brand becomes a secondary consideration to the best pricing and promotional activity a business can offer – something that’s tough for small businesses with slim margins.

This makes sense from a commercial standpoint, but shoppers aren’t only motivated by price – they look for other factors in products they buy, too.

“It’s been recognized through research that when it comes to choosing products, price is a consideration, but well down the priority list initially,” Tony says. “It’s not the first consideration, it’s whether a product meets a shopper’s lifestyle, it is a combination of their dietary requirements, personal taste preferences, and aspirational health choices and if you can get all those other bits correct then you're not drawn into just the price point.”

A recent Ipsos studyOpens in new tab into the retail grocery sector in New Zealand found that consumers are more likely to visit a store if they know that the store has the products they need and a greater range of options available for those products.

This means a broader range of products is an important driver of their store choice, because it increases convenience and means they don’t have to go shop elsewhere.Supermarkets also rely on shopper data gathered from customers by companies like IRI and Nielsen to inform their insights, but often it’s information gathered from purchase decisions made by the shopper weeks – or even months – before.

Tony says that this data looks back at what’s happened in the past, while Tracksuit’s data is looking forward at future demand.

“One of the parts we like about Tracksuit is you’re measuring the user or consumer, not the shopper making the purchase. It captures not just the shopper, but where the consumers’ tastes are.

“Tracksuit measures their preferences now, which gives us clues as to where their preferences are heading in the future. This is helpful for new product development (NPD) as you get a better feel for where consumers’ minds and preferences are going.”

Surge SMC Key Account Manager Fiona Mancer says having this data on hand puts their brands in a position of equality when entering conversations with stockists as suddenly, the conversation isn’t so one-sided.

This is because businesses have evidence of their own brand strength and also consumer preferences, which helps the brands educate stockists on what shoppers actually want.

“If we go in showing consumer data from Tracksuit that demonstrates brand strength or even just activity tracking, we paint a more holistic picture,” Fiona says. “We can come to our side of the conversation with supermarkets with more anecdotes and consumer behavior trends that they can’t capture in their data because they haven’t happened yet. And it’s not just us we’re tracking, it’s what our competitors are doing too.”

Finding local success

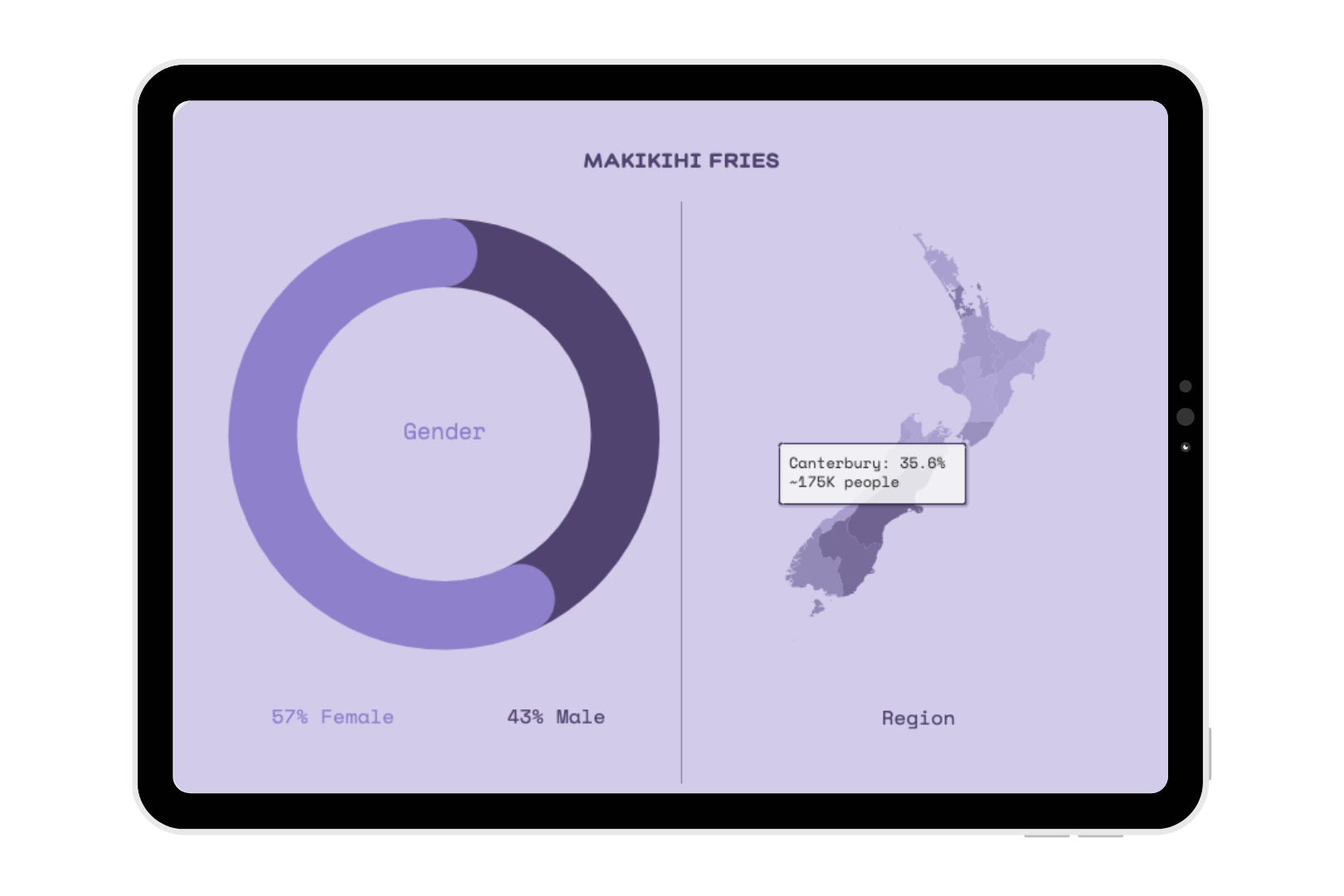

The brands in Surge SMC’s portfolio are strong performers in their respective local markets. Makikihi Fries produces their chips in South Canterbury, and the brand’s strong foothold locally is reflected in their Tracksuit data. In Canterbury, Makikihi Fries is over-indexing in terms of brand awareness, with ~175,000 people aware of the brand.

Makikihi Fries is also a strong performer in the rest of the South Island, with brand awareness increasing 8% in the last 3 months. At today’s category size, that equals ~167,000 humans who are aware of the brand, down South, outside of Canterbury.

Preference in the rest of the South Island has also increased by 6%, with an extra ~20,000 humans preferring Makikihi Fries out of all the brands in the frozen oven chips category.

💡 Preference is the hardest metric to move in the marketing funnel, as consumers are forced to select a single choice when asked: ‘Which is your preferred brand of frozen oven chip?’

Fiona says Surge SMC’s territory managers find the Profile tab (pictured above) helpful to filter by age, location, region and pull out specific insights, depending on what store they’re talking to.

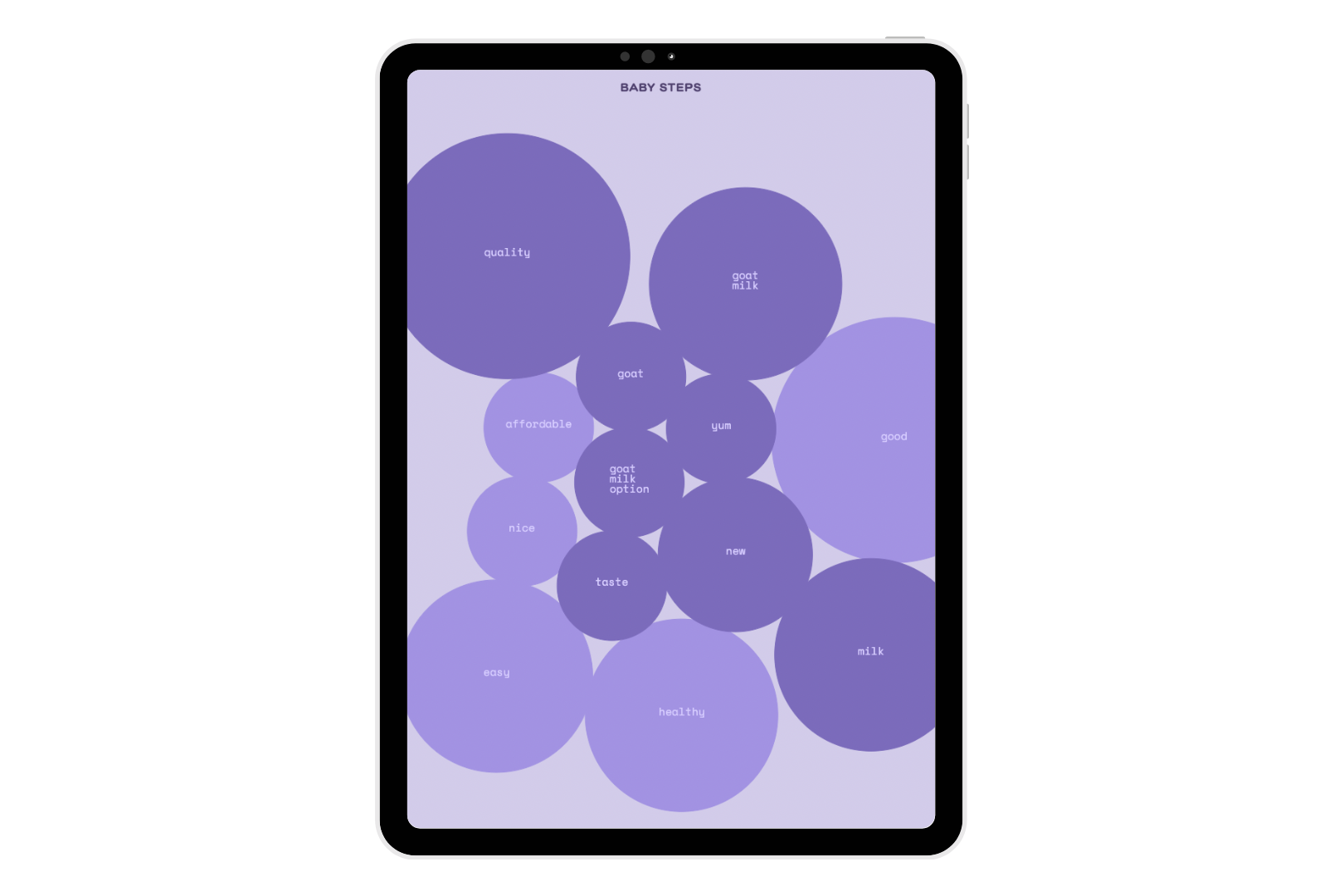

Meanwhile, Baby Steps’ key brand messaging is also resonating with people. On the Imagery tab, consumers are demonstrating strong knowledge of Baby Steps’ key value props by recalling its point of difference (that it’s made from goat milk) and of a high quality.

Fiona says in terms of her usage of the Tracksuit dashboard, she uses the Timeline and Imagery tabs the most. She says these word clouds are helpful to cross reference with the messaging of Surge SMC’s brands on social media, as they can find out what is resonating best with people.

This also helps with social media campaigns, as they can analyze the data to see where they should focus their efforts around New Zealand.

“Tracksuit gives us some good indicators for where there’s an opportunity with different regions, ages and genders. It narrows down who brands should be targeting and why and makes that social media spend more targeted and worthwhile,” Fiona says.

“I see it as this holistic approach. We can get sales data, draw down reports and social media data, and if you couple that with Tracksuit’s data you get a very holistic view of your consumer and your total market.”

The 'El Dorado' of brand strength

Surge SMC is continuing to support their portfolio of brands by using insights gleaned from Tracksuit to guide their clients on what consumers are responding to and what framework for NPD is best.

Tony says a lot of the clients they represent have innovative products that are at the cutting edge, so it’s Surge SMC’s job to monitor how the market is embracing these brands.

The big, audacious goal for their clients to aim for is becoming a ‘destination product’ rather than a product people pick up on their way through the supermarket.

“That’s the nirvana and the 'El Dorado' of brand strength – if you can get to a point of people changing the way they shop to reach your product.”