How Tracksuit tracks brands in the UK

Here at Tracksuit, we’re all for helping ambitious brands grow through affordable, always-on brand tracking. In this article, we dive into the how – AKA the nuts and bolts of how we actually track brands in the United Kingdom 🇬🇧

We know this area can get a tad jargon-heavy, so we've kept it simple, covering:

- Our survey methodology

- The data sources we use

- The survey process when you join Tracksuit.

Let's get started!

Every day, we survey real-life humans from the UK to measure and understand your brand's health 🙋

Tracksuit is always-on, collecting data from humans who have willingly chosen to participate in surveys.

We cast a wide net when it comes to demographics, including age, gender, region, ethnicity, and income. This diverse sampling creates a nationally representative survey, ensuring our findings can be applied to the entire UK market.

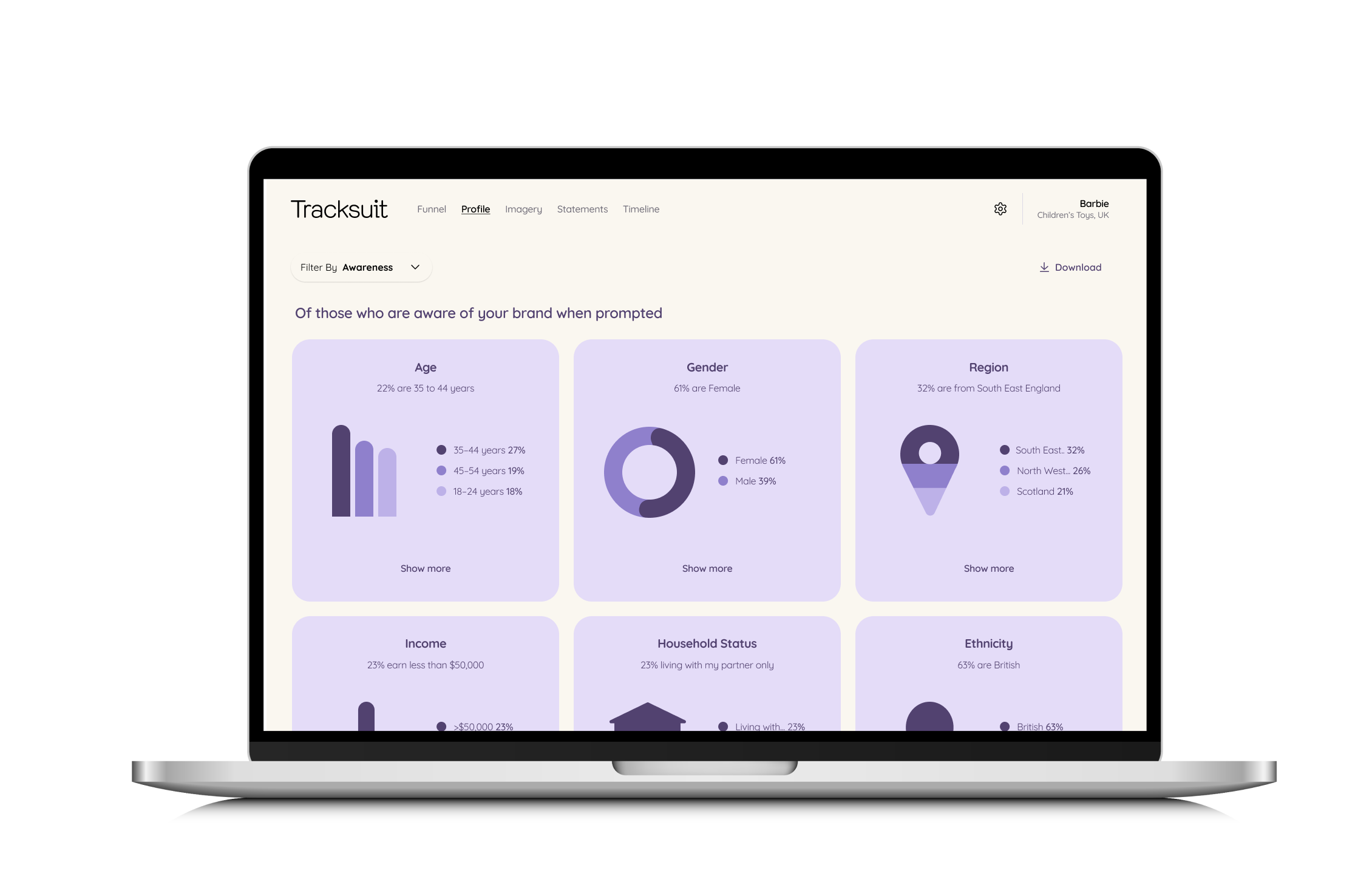

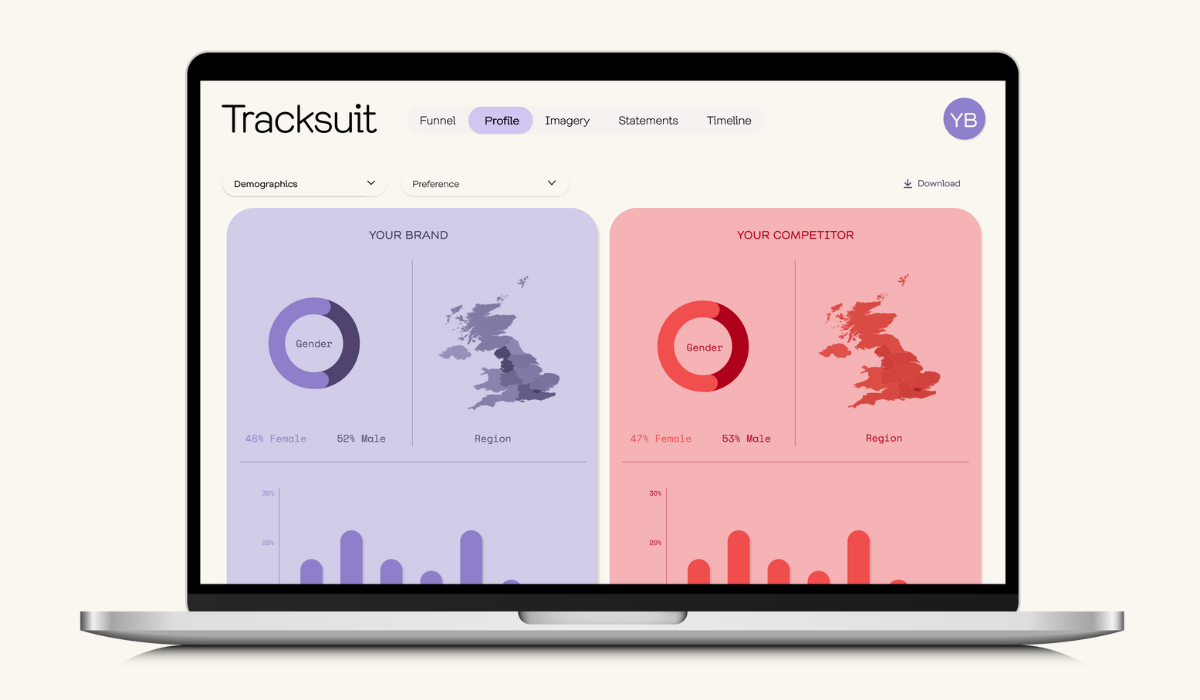

While you can't cherry-pick specific demographics for exclusive surveys, once you're in the Tracksuit dashboard, you can effortlessly filter your brand metrics to focus on the demographics you care about.

This flexibility allows you to pinpoint how your brand metrics vary among different groups, offering valuable insights for your marketing strategy.

Data sources 🔎

We partner with a reputable third-party panel provider called Dynata. This same source is used by major enterprise-level brand trackers with heavyweight clients such as Amazon and Shopify. This partnership ensures our data is of the highest quality.

Survey participation motivations 📋

It's not just financial incentives that motivate our respondents to answer our surveys! Some people genuinely enjoy sharing their opinions, while others like to influence how products are marketed to them.

Respondents do receive compensation for their participation, typically in the form of points that can be exchanged for rewards.

We believe that when brands have better insights about what’s resonating with their market, there’ll be better ads out in the world, and we hope our survey respondents share this motivation!

Geographic breakdown 🇬🇧

To ensure our data represents the entire UK market, we collect postcodes from our survey participants. Currently, we categorize respondents into 12 regions:

- East Midlands

- East of England

- Greater London

- North East England

- North West England

- Scotland

- Northern Ireland

- South East England

- South West England

- West Midlands

- Wales

- Yorkshire and the Humber

What happens after you sign up for Tracksuit? 📈

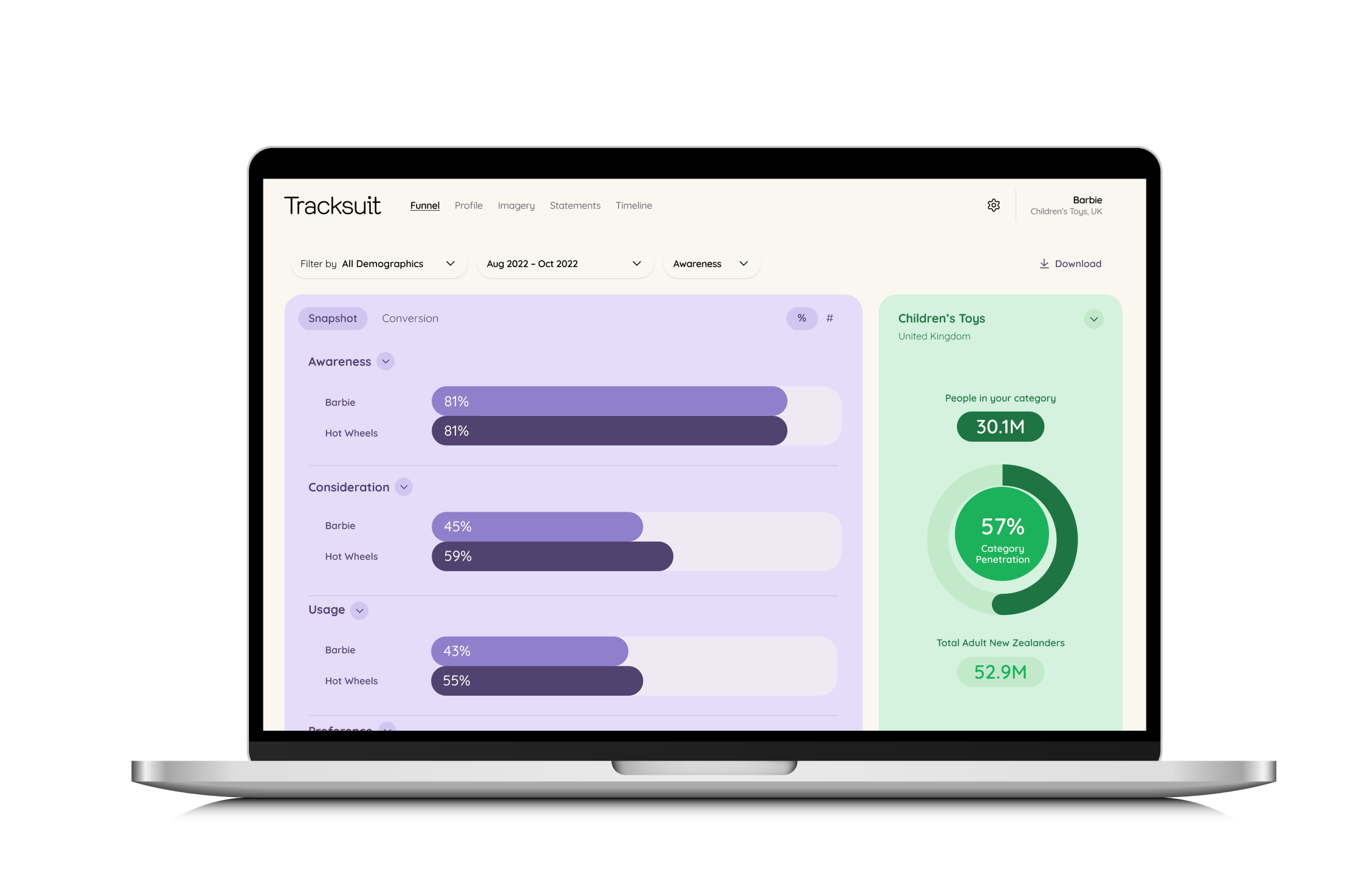

Month 1: Benchmarking

Once you’ve joined Tracksuit, we launch thousands of surveys to a nationally representative sample to create a benchmark. This benchmark is based on a minimum of 1000 respondents within your category. It provides a starting point for tracking your brand metric’s growth.

You can think of categories as industry segments. A category could be health supplements, exercise equipment, or breakfast cereals, for example. If your business has multiple brands, you can track them in different categories.

The 1000-sample size ensures a 95% confidence level, meaning that if we surveyed the entire UK population, our results would be very close, with only a small margin of error.

Since surveying the entire UK population isn't practical (and would cost you a pretty penny), these statistics allow us to confidently generalize our findings.

The margin of error for a 1000-sample size is less than 3.1%, which is the industry standard for enterprise brand tracking.

Won't a larger sample size give better results? 📊

Increasing the sample size beyond 1000 only slightly improves accuracy. For example, doubling our sample size to 2000 only reduces the maximum margin of error by 1.1%. Plus, if we doubled the sample size, we'd need to survey more folks, which would come at a higher cost. We don’t reckon the incremental gains would be worth it!

Months 2 to 12: Rolling average

Starting from the second month, you gain access to the beautiful Tracksuit dashboard.

We survey at least 340 people in your category each month, with responses coming in daily thanks to our continuous survey approach. This enables you to monitor how seasonality affects your metrics and how your marketing campaigns impact growth in near real-time.

Say goodbye to bulky, unread reports that gather dust on your desk and say hello to the convenience of the Tracksuit dashboard. You can login whenever you want to see your brand metrics, and how they’re changing over time.

What's next? 🏃

If you're itching to dive deeper into the details, why not request a demo with one of our brand experts?

We're here to support brands that are bold, ambitious, and ready to make their mark on the world. We hope yours will be next!

Until next time, brand champion! 🚀