How Nike’s pivot away from brand lost the market

Nike has seen both its revenue and stock prices plummet in the last few years, struggling under the leadership of former CEO John Donahoe – and Tracksuit data shows Nike’s brand health has suffered the same fate.

- Nike has lagged behind in product innovation and cultural relevance in the last few years, failing to invest in what they’ve always been known for: brand building.

- By deprioritising emotional advertising, retail partnerships, tastemaker collaborations and other brand building activity in favour of rational performance marketing, Nike’s lost its way in both revenue and brand perception.

- In the last six months, from April ‘24 to Sep ‘24, the amount of people in the United States that prefer Nike has gone down 6% – that’s ~8M less people.

Nike is often trotted out as a shining example of how to build good brands. It’s a company instantly recognisable by its ubiquitous swoosh and ‘Just Do It’ slogan, having created strong ties with generations of sneakerheads, sport fanatics, and everyday athletes.

It hasn’t always been an easy road. Established in 1964, Nike struggled until it found its footing by signing Michael Jordan to promote their Air Jordans in 1984 (the story has been immortalised in the 2023 film Air). Since then, Nike has stayed at the forefront of the cultural story with celebrity brand deals and creative marketing that kept them relevant for decades, backed up by continuous product and design innovation.

While it took years to build Nike to where it is today, the last few years have proven that all of this can go pear-shaped – and fast. Nike has experienced a downward trajectory that we’d prescribe as a bit of a “flop era”.

Sales have plummeted. Revenue has been down 10% year-on-year, and fell to $11.59 billion for the first fiscal quarter of 2025 (it was $12.94 billion the year prior). Stock prices have also been on a tumultuous rollercoaster – notably, on June 28 2024, Nike’s stock value fell 21%.

Tracksuit’s brand tracking shows that this lines up, with data reflecting the fact that consumers have been pulling away from Nike as a brand.

We’ve been tracking Nike in the US for the last six months, and from April ‘24 to Sep ‘24, all of its funnel metrics have decreased.

Nike has the highest Awareness of all its competitors in the category (94%), but the rest of the marketing funnel reflects that people’s intent to purchase has significantly declined. This decline is despite the number of people in the category in the US growing by 2% over the last six months.

Usage has gone down 4% from 81% to 77%; Consideration down 6% from 79% to 73%; and Preference down 6% from 39% to 33%. In terms of human numbers, this means ~5.7M less people consider Nike when purchasing sportswear, and ~8M less people now prefer the Nike brand.

Much of Nike’s struggles have been pinned on former CEO John Donahoe, who resigned from the company just a few weeks ago. Donahoe was the second ever CEO to come from outside Nike, and at the start of the tenure was noted having little experience within the sportswear industry: a fact that would ultimately signal a fundamental mismatch with Nike’s market leading product innovation strategy.

He is now due to be replaced by Nike veteran Elliot Hill, who had worked at the company for 32 years; in Nike’s press release announcement of the news, opens in new tab, Hill was described as having a “deep understanding of the industry and its partners.”

Under Donahoe, Nike leaned hard into the digital, pumping up its e-commerce strategy by honing in on user experience on its website (plus entered the metaverse and bought a NFT studio). It seemed to work – at first. Though direct-to-consumer sales increased, it took a while to feel the pains of the deprioritisation in retail and consumer experiences; namely that its competitors had swooped in on the physical shelf space left empty by Nike in retail stores all over the globe. Nike also decreased its investment in product innovation, relying on the nostalgia effect with old favourites like its Dunks.

Something else Nike stepped away from doing? Brand marketing.

“A long time ago, the Father of Management Peter Drucker said that ‘because the purpose of business is to create a customer, the business enterprise has two - and only two - basic functions: marketing and innovation. Marketing and innovation produce results; all the rest are costs,’” James Hurman, the Co-Founder of Tracksuit said.

“For decades, Nike was one of the few companies that not only understood that Drucker was right, but executed relentlessly and consistently on those two basic functions. Then somehow they blinked, installing leadership that turned away from the wisdom and instead saw marketing and innovation as costs to be reduced.”

Sign up to Shorts

For fortnightly brand insights, stories and goodness that'll help you win.

What went wrong with Nike’s marketing strategy?

Nike’s former brand director, Massimo Giunco, probably summed it up best in his infamous LinkedIn takedown post, opens in new tab when he said, “Well, the brand team shifted from brand marketing to digital marketing and from brand enhancing to sales activation.”

Essentially, Nike has been guilty of a cardinal sin: investing too much in performance marketing and not enough in brand.

Donahoe was widely known as data-driven. This emphasis on performance digital marketing unfortunately came at the expense of investing in the emotional, narrative-driven advertising of Nike’s past – many of which have set the benchmark for hugely successful emotional campaigns (take the Find Your Greatness campaign, opens in new tab, for example). They've also not shied away from controversy, attaching themselves to emotion-driven causes like Colin Kaepernick, the NFL star who kneeled for the national anthem in protest of racial injustice. Despite the controversial stance, Nike's stock rose by 5% in the weeks following an ad they ran featuring Kaepernick.

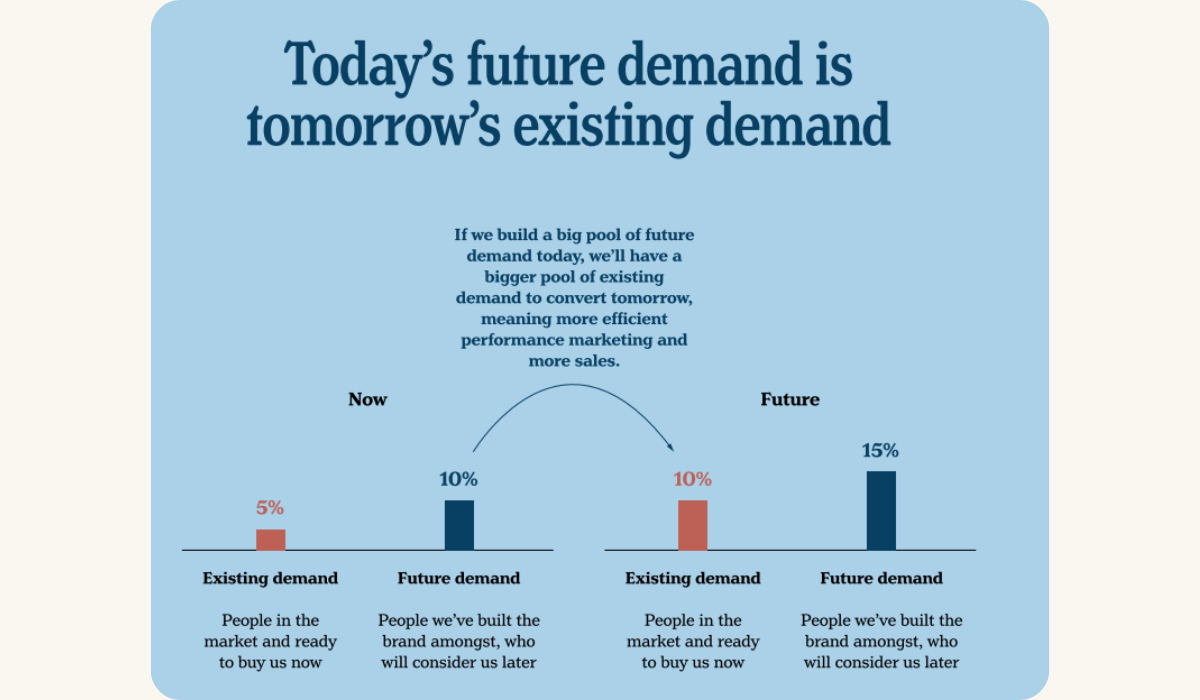

In recent years, more of Nike’s marketing dollars went into serving existing demand, not creating Future Demand.

It wasn’t just the more traditional advertising that suffered. It also shied away from partnerships with culturally relevant collaborators, and flooded its channels with more rational, logic-based messaging. In addition, it didn’t keep up with the brand’s baked-in “coolness”, no longer teaming up with boutique sneaker stores or other tastemakers to the same extent as it used to, which affected its cultural capital – and sense of community.

Our data shows that in the US Sportswear category, the most effective quality driving buying intent (that is, conversion from awareness to consideration and consideration to preference) is that customers believe the brand 'Is for people like me'. This may be a reason why Nike's brand health metrics have fallen: they've simply lost touch with the culture and people no longer see themselves in the brand.

While Nike’s brand building slipped and consumer perception shifted from aspirational to old-school, other players like Hoka and On Running stepped into that space. Hoka in particular has been accruing sweet cultural capital, opens in new tab for a number of years now.

James Hurman warns that this is not a unique story – and that Nike’s cautionary tale serves as an opportunity for others to capitalise on.

“Yes, John Donahoe was a fool not to have grasped what made Nike great and a double fool for believing he could cut his way to growth. But he's hardly alone.

“We have an epidemic of business leaders who Don't Get It. They're the startup founders who innovate but don't commit to proper marketing, doing well at first and then plateauing out. They're the corporate CEOs who pour money into marketing but never innovate, taking the lazy path of living off of the company's past successes rather than living up to them, as they meander away from growth. And they're the managers of the vast majority of companies that excel at neither, and just float around vulnerably like business detritus.

“Your competitors Not Getting It is your opportunity. Build Future Demand through great innovation and great brand marketing and you'll leave them in your dust.”

Nike’s brand performance tracks differently across the globe 🌎

Tracksuit data shows a trend downwards in the other Northern Hemisphere market we’re tracking (Canada), though the impact hasn’t been as significant. For example, Preference is down 3%, from 58% to 55%, in the last six months.

It’s a slightly different story Down Under. In New Zealand, for example, Nike has actually seen a small boost in its metrics. Consideration has gone up in New Zealand by 4% from 74% to 78%.

This shows that while Nike is global, the impact of its lack of brand investment has been deeply felt in the United States: the home of the brand and where it was founded over 60 years ago.

There is, of course, signs that Nike will be turning around and getting back on track. In addition to its appointment of Elliot Hill, it has just released the second chapter of its 'Winning Isn't Comfortable' campaign amidst all the noise of their downfall, highlighting the everyday challenge of getting down the stairs after a marathon run.

We'll continue to track Nike's metrics – see you back here soon in another few months for a check in.